What is Fed Med/EE Tax?

One withholding employees see listed on their earnings statements is the Fed MED/EE Tax. This stands for Federal Medicare/Employer-Employee and is a tax that funds the Medicare Health Insurance program. This tax is a part of FICA, the Federal Insurance Contributions Act, which consists of both Medicare and Social Security Tax. All employees and employers in the United States are required to pay their portion of the Fed MED/EE tax, which is taken out of a person’s paycheck.

In this guide, we will discuss everything from the definition of the Fed Med/EE Tax and where to find it on your paycheck, to exemptions to deductions to how it applies to self-employed individuals.

What does Fed Med/EE pay for?

If you’re an employed adult, chances are you’ve heard of the Medicare Health Insurance program, but if you’re not enrolled in the program, you may not know exactly what you are contributing to when you see the tax withholding on your paycheck. The Medicare program provides the following services for individuals with work-related disabilities and those individuals who are 65 years old or older:

- Medical care

- Medical treatments

- Physician-prescribed medications

- Hospital visits

Fed MED/EE on your Paycheck & Other Withholdings

Most people get their pay statement and do a quick scan until they find how much money will go straight into their pocket from the week. However, if you take the time to look through all of the taxes and withholdings, you may be surprised at how many items are listed that you are not familiar with. This is likely because many pay statements use the formal names for these taxes, rather than simply stating “Medicare.”

In this video from Paxton Patterson College Career Prep, you’ll learn exactly how to read your paycheck and understand those statement withholdings that once seemed confusing.

Okay, now that you have the gist of the main withholdings you will find on your weekly, biweekly, or monthly paycheck, let’s break down what’s in the video a bit more and discuss how exactly you should be reading your paycheck.

Taxes, Deductions, and Benefits

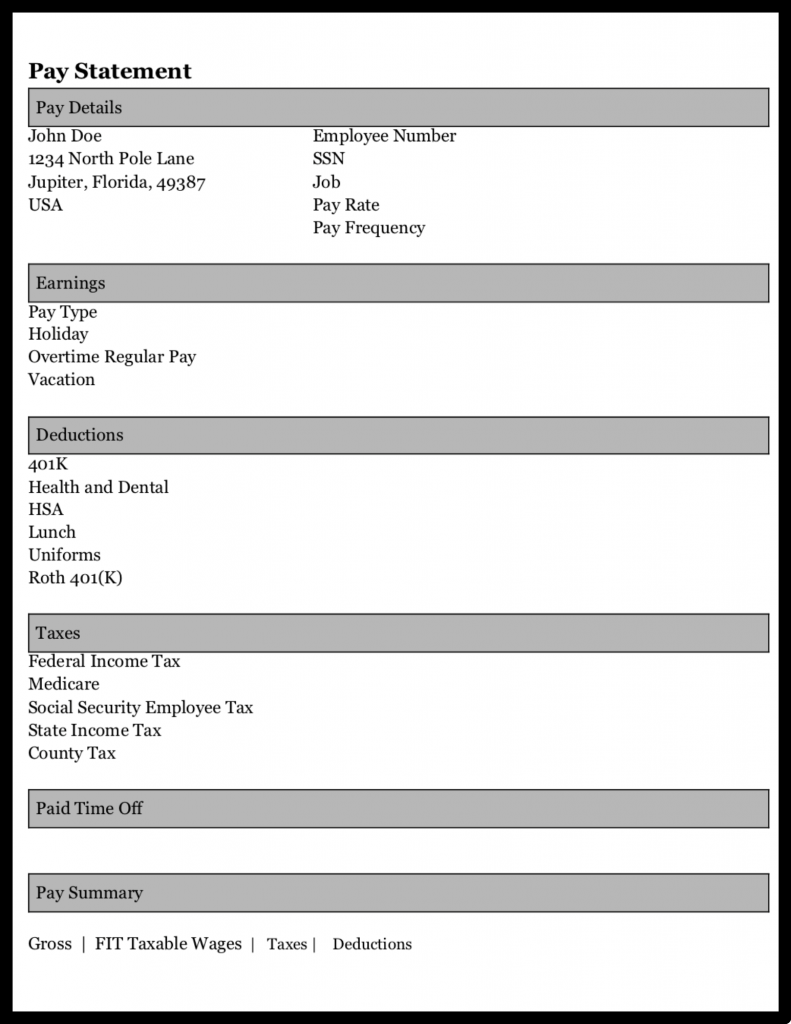

Pay statements are broken up into different sections, including pay details, earnings, deductions, taxes, paid time off, and more. The way a statement is formatted may vary depending on the provider your company uses for pay roll, but they will all generally include the same kind of information.

In this diagram, you can find where to look for each piece of information on your paycheck. You’ll notice the Fed Med/EE (Medicare) tax is listed under the “Taxes” section.

Pay Details – This includes your basic information that pertains to your job, like your full name, address, employer number, social security number, job title pay rate, etc.

Earnings – This section highlights what you have earned during a pay period, as well as things like holiday pay, vacation time, and overtime.

Deductions – Depending on what you contribute to and what your company offers, deductions on your pay statement will include things like your 401 (K), childcare, stock, work uniforms/supplies, and food/beverage purchased while at work.

If you are enrolled in an insurance and/or health savings plan through your employer, you will see those benefits show up on your pay stub, as well.

- Medical Insurance

- Dental Insurance

- Life Insurance

- Health Savings Account (HSA)

Taxes – Federal income tax, state income tax, county tax,Medicare (FED Med/EE), Social Security (Fed OASDI, Old Age Survivor and Disability Insurance).

Depending on your employment status and what kind of benefits you have, your paycheck may look slightly different. However, every employed American must pay the same kind of taxes (FICA [Medicare and Social Security]) and federal, state, and local income taxes. If you are a self employed individual, you will not have your taxes taken our automatically. Instead, you will have to withhold them yourself and pay them in the form of quarterly estimated taxes (more on that in a bit).

If you have certain insurance or disability with your employer, your pay statement may vary.

Other Names for Fed/Med EE Tax

Some paychecks will have the Fed/Med EE withholding listed under other names, such as:

- Federal EE – Medicare

- Medicare Tax

- Medicare

- FICA Medicare

- Medicare 1.45%

Any variation of the above is referring to the Fed/Med EE tax and is usually listed immediately following Social Security (or OASDI/EE) taxes, but they all mean the exact same thing.

What Is Fed OASDI/EE Mean on a Paycheck?

Is Fed Med/EE part of Federal Withholding?

Yes, Fed Med/EE is a federal withholding tax, along with Social Security and federal income tax. Both Medicare and Social Security taxes are only withheld on the federal level, not on a state or county basis like some other taxes you’ll see on your paycheck.

Fed Med/EE Percentage 2021 – How is it Calculated?

The Medicare (Fed Med/EE) tax rate percentage for 2021 is 1.45 percent, the same as it was in 2020. The Fed MED/EE Tax rate is 2.9 percent of gross income. The employee pays 1.45 percent and the employer pays a matching 1.45 percent. Self-employed individuals will pay the entire 2.9 percent.

Here’s a look at the FICA tax rates for 2021:

| FICA Tax Rates | Employee Contribution | Employer Contribution | Total |

| Medicare (Fed Med/EE) | 6.20% | 6.20% | 12.40% |

| Social Security (OASDI/EE) | 1.45% | 1.45% | 2.90% |

| Medicare + Social Security | 7.65% | 7.65% | 15.30% |

*Additional .9% Medicare Tax for people who earn more than $200,000 ($250,000 for joint filers)

What is the Medicare Tax Limit for 2021?

Unlike the Social Security tax which has an income limit on how much tax is paid, there is no limit on the Fed MED/EE tax. This tax is paid on everyone’s earnings, no matter how small or how large the annual amount. The percentage that you must pay on Medicare taxes may increase, depending on your income. If you make more than $200,000 per year, you are subject to an increase in Medicare taxes based on the Affordable Care Act’s Additional Medicare Tax (we’ll discuss more on that later in this article).

What is the difference between Fed Med/EE and Fed OASDI/EE?

While both Fed Med/EE and Fed OASDI EE are both a part of FICA, they are two separate taxes that show up on pay statements. Fed Med/EE is Medicare tax, while Fed OASDI EE is Social Security tax. To learn all about Social Security tax, check out this guide: What Does Fed OASDI/EE Mean on a Paycheck?

Fed Med/EE Tax Exemptions

Every person, with a few rare exceptions, who earns a paycheck, will have this payroll tax deducted from the gross salary earned, but it is not part of the Federal taxes paid for income tax purposes. An example of an exception to this payroll tax is when both the employer and employee are members of a religion that is opposed to insurance based on their divinity’s doctrine.

“An exemption from Social Security and Medicare taxes applies to non-immigrant students, scholars, teachers, researchers, and trainees (including medical interns) who are temporarily present in the United States in F-1, J-1, M-1, or Q-1 status, as long as they remain non-residents for federal income tax purposes,” according to TheBalance.com. “The exemption also applies to any period in which a foreign student is in “practical training” or other off-campus employment allowed by U.S. Citizenship and Immigration Services (USCIS).”

If someone thinks that they may have justification for an exception to paying this tax or already qualify for an exception to paying this tax, can talk with an IRS agent or consult a tax advisor for guidance. All other wage earners are required to pay this tax.

Medicare Tax Refunds

Employees who have overpaid on their Medicare taxes are eligible for a refund. To pursue getting a refund on your FICA taxes, you will need to first claim this with your employer. If that is not successful, you will need to attempt to get your refund when you file your taxes with the IRS on a Form 843 (Claim Refund or Request for Abatement).

Self Employment & Fed Med/EE

If you are self-employed, handing Fed Med/EE taxes is not quite as simple. First off, those taxes are not automatically withheld on your paycheck like they are for employed people. And second, self-employed people are responsible for paying both halves of Fed Med/EE tax (so, the entire 2.9%), as well as the other part of FICA, Social Security Tax. Medicare and Social Security taxes make up a total of around 15.3% of a self-employed person’s income.

Paying the IRS for these taxes can be confusing at first, but once you get the hang of it, it isn’t too bad.

“As a self-employed individual, generally you are required to file an annual return and pay estimated tax quarterly.

Self-employed individuals generally must pay self-employment tax (SE tax) as well as income tax. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. In general, anytime the wording “self-employment tax” is used, it only refers to Social Security and Medicare taxes and not any other tax (like income tax).”

Why isn’t my employer withholding Fed Med/EE?

If you are under contract as a W2 employee, your employer should be paying for half of your Medicare tax. As stated above, Medicare tax is 2.9% of your income, but as an employed individual, you only have to pay 1.45%, and your employer is responsible for paying the other 1.45%.

Keep in mind, if you are a freelancer, contractor, self-employed person, or any other kind of worker, the business you work for is not responsible for paying the other half of your Medicare tax. If you are an employed person and you believe your employer is not withholding Fed Med/EE tax, contact your human resources department. If there are still concerns after trying to resolve this issue with your company, you can reach out to an IRS agent at 1-800-829-1040.

Can you deduct FED/Med EE from your income taxes?

Individual taxpayers cannot list the Fed MED/EE tax as an expense on their income tax forms. Only Federal income tax can be listed as an expense for IRS purposes. Self-employed individuals who pay both the employer’s and employee’s share of the tax can list the employer’s 1.45 percent portion of the tax as a business expense on their company’s income tax, but not the employee’s 1.45 percent portion on their personal tax forms. Employers can find the guidelines on Fed MED/EE tax calculations at the IRS website: https://www.irs.gov/

How can I reduce my FICA tax?

FICA taxes are fixed percentage of your income, so you cannot lower the rate that you have to pay. However, you can reduce the amount of taxable income you have by claiming deductions, which will lower the overall amount you have to pay in to the IRS.

What does “Fica EE” mean?

FICA EE is a common misnomer for the income tax, FICA. FICA stands for Federal Insurance Contributions Act, which is a total of 7.65% of your income. It is made up of both FED/Med EE (Medicare, 1.45%) and Fed OASDI/EE (Social Security, 6.2%) taxes. You typically will not see the term FICA listed out on your paycheck or pay statements since the individual Medicare and Social Security taxes are listed instead.

History of Medicare Tax

The subject of healthcare in America is not a new topic of conversation. In fact, it was a long road from the time the idea of a national healthcare program was proposed to the time it actually came to fruition. There were tentative plans and communication about a healthcare program throughout President Teddy Roosevelt’s administration, but it wasn’t until nearly 50 years later that the legislation went through and the program rolled out under the Johnson Administration.

Medicare tax started out as 0.7% back in 1966. Just like today, employees paid half, and employers paid half. Over the years, the tax has increased to 2.9% and is projected to continue going up as the national healthcare program grows and evolves.

Fed Med/EE and the Affordable Care Act

In addition to lowering the cost of healthcare for Americans, the main purpose of the Affordable Care Act has been to increase Medicare taxes for employees who earn more than $200,000 per year, decrease the cost of prescription drugs, increase premiums for wealthy people, offer preventative services free of charge (annual exams with physician, patient prevention plans, mammograms, etc.).

According to healthcare.gov, the plans available through the Affordable Care Act Marketplace must include the following “essential health benefits”:

- Ambulatory patient services

- Emergency services

- Hospitalization

- Pregnancy, maternity, and newborn care (both before and after birth)

- Mental health and substance use disorder services, including behavioral health treatment (this includes counseling and psychotherapy)

- Prescription drugs

- Rehabilitative and habilitative services and devices (services and devices to help people with injuries, disabilities, or chronic conditions gain or recover mental and physical skills)

- Laboratory services

- Preventive and wellness services and chronic disease management

- Pediatric services, including oral and vision care (but adult dental and vision coverage aren’t essential health benefits)

- Birth control coverage

- Breastfeeding coverage

Essential health benefits can be different depending on your state of residence. There are multiple plans employees can enroll for. Some of the additional benefits included in plans are:

- Dental coverage

- Vision coverage

- Medical management programs (for specific needs like weight management, back pain, and diabetes)

Essential health benefits list provided by Healthcare.gov.

Additional Medicare Tax

The increase in Medicare tax on the highest earning individuals is called the Additional Medicare Tax. This applies to employees who make more than $200,000 per year, or $250,000 if you’re filing jointly with your spouse. The additional tax is another .9% on top of the 1.45% that all employees are required to pay for Medicare tax. The Additional Medicare Tax does not require employers to split the additional .9%, though – employees must pay the total of 2.35% Medicare tax themselves.

Keep in mind, the Additional Medicare Tax is only applied to income that surpasses $200,000. If an employee makes $300,000 in a year, they will have to pay 1.45% in Medicare tax on the first $200,000 and 2.35% on the last $100,000.

“Another result of ACA reforms is the Net Investment Income Tax (NIIT). The NIIT, also known as the Unearned Income Medicare Contribution Surtax, is a 3.8% Medicare tax that applies to investment income and to regular income over a certain threshold,” According to smartassetcom. “If your Modified Adjusted Gross Income exceeds $200,000 ($250,000 if you’re married and filing jointly) you may be subject to the NIIT. Examples of investment income that is subject to the NIIT include dividends, interest, passive income, annuities, royalties and capital gains.

The 3.8% tax applies to the lesser of either your net investment income or the amount by which your MAGI exceeds $200,000 (or $250,000 for joint filers). That means the NIIT acts as either an extra income tax or an extra capital gains tax. You can report your net investment income on IRS Form 8690.”

Medicare Tax Statistics for 2021

- Fed Med/EE stands for Federal Medicare Employer-Employee tax, which is currently a total of 2.9%, split evenly by an employee and employer.

- There is no income limit for Medicare tax, unlike Social Security tax.

- Medicare is likely to cover nearly 18% of federal government spending by 2028, MedicareResources.org

- The program currently provides insurance for nearly 60.6 million Americans, MedicareResources.org

- When Medicare first rolled out, it was a total of 0.7%, split by the employee and employer, Smartasset.com